Nurturing your prospects in life science marketing and sales—Part 1

By David Chapin

SUMMARY

VOLUME 8

, NUMER 4

There is a great deal of misunderstanding about lead nurturing in the life sciences. Apparently, some see nurturing as a chance to continue their strong-arm sales tactics. And some see nurturing as a waste of time. What is nurturing, and what’s the best way to go about it? In this issue, I begin to explore this fascinating topic by asking a very simple question—what exactly is nurturing?—and exploring opportunities for nurturing through each of the stages of the sales process.

An actual conversation about nurturing sales prospects in the life sciences.

“Oh, we give the prospect everything we can—all the data and all the information—right up front, so they have everything they need to make their decision.”

“But what if they’re not going to be ready to buy for 6 months, or a year, or maybe two?”

“Well, the salesperson will call them from time to time.”

“So, are those calls made according to some sort of preplanned schedule, like once a month?”

“No, it’s up to the individual salesperson to decide when to call.”

“Do you offer the prospect anything during these calls, like whitepapers or webinars?”

“No, all of that information is given to them right up front, and of course it’s on our website.”

During the diagnostic process we employ here at Forma, we conduct an audit of our clients’ life science sales and marketing efforts. It’s important to understand the type and level of support that life science companies provide to maximize the efforts of their salespeople, so we ask lots of questions. We interview sales people and their managers. We ask about their sales processes and procedures.

We ask how the marketing function supports—or doesn’t—the sales function. We ask about the dividing line between sales and marketing, such as where leads get handed off from marketing to sales. We ask several salespeople to give us a sales presentation. Over the years we’ve seen lots of these presentations—some of them pretty good, many of them mediocre. We ask all these questions—and more—because we need to know the answers if we’re going to deliver results.

It was during one of these diagnostic audits that the above conversation took place. I asked the initial question because I didn’t find much compelling thought leadership on their website; I wanted to know how they nurtured their clients, given their lack of obvious nurturing tools. And I have to say that at the time, I was dumbfounded by the response. I still am. This is a global, top-five life science company. Everyone knows their name. And yet they’re apparently unaware that this thing called “nurturing” even exists. And as a result, they’re making fundamental mistakes that are hurting their chances of landing new business.

This conversation crystallized my decision to write about the idea of nurturing prospects in the life sciences—and the correct way to go about it. It’s clear that there are some bad practices out there, so I’ll start with the basics. It all begins with a simple question: Why should we nurture our prospects?

It turns out that there are lots of different reasons, and they’re all positive. In fact, if you’re not nurturing your life science prospects correctly, you’re missing a huge opportunity.

I’ll set the stage by talking about what nurturing is (as well as what it isn’t) and discuss briefly some of the tactics we can use for nurturing. I’ll dissect the different stages that buyers go through prior to purchase and the different types of nurturing that life science buyers need in each stage. Then in the next issue, I’ll explore some of the reasons we need to have a clear and effective nurturing campaign in place. And in future issues, I’ll cover some of the basics stages that organizations themselves go through as they mature in their efforts to properly nurture prospects.

What is nurturing?

When we “nurture” a child, we care for them; we create a relationship with them so we can guide their growth and development. Nurturing our life science prospects is similar. It’s the process of building a relationship with our prospects, one that allows us to help them by guiding their transition from one stage in the buying cycle to another.

Please note that I’m considering nurturing in the context of large-ticket sales, ones with long sales cycles that are closed by a salesperson. I’m not talking about impulse purchases, such as buying a soda or a candy bar, as those decisions happen so quickly that they can’t be nurtured.

What nurturing in the life sciences is NOT.

It’s important to point out what lead nurturing is not. Lead nurturing is not the entire process of demand generation; nurturing is just one part of this process. Lead nurturing is not sales; sales has many, many steps, including the identification of prospects who have a need, qualifying those prospects and then navigating these opportunities to a successful close.

Lead nurturing is not marketing automation or CRM; we shouldn’t confuse the process (establishing a relationship) with any of the tools (phone calls, white papers or other content, email, marketing automation software, CRM, etc.) used to accomplish the process. And finally, lead nurturing is not strong-arm sales tactics (“I’m going to make an offer and you’ll take it or I’ll break your legs”).

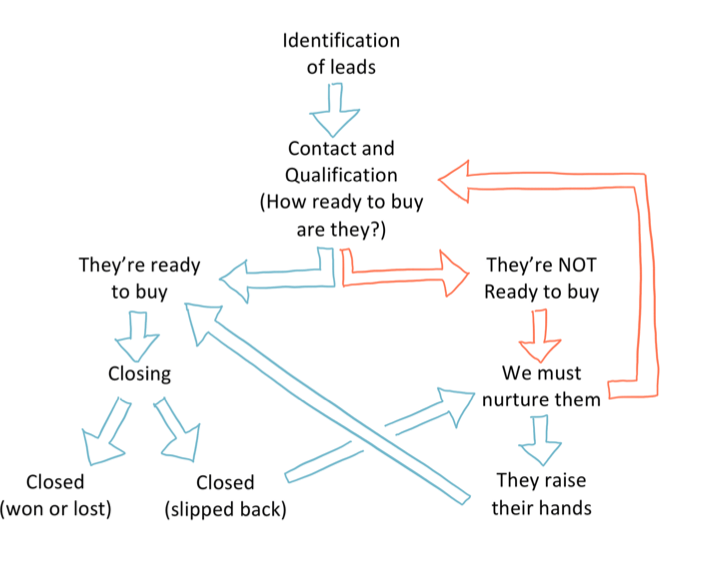

Sometimes we qualify opportunities and they are immediately ready to close. But more often that’s not the case. Those opportunities are the ones we need to nurture. Remember that nurturing is just one component of marketing and sales, a distinct component that can be utilized at several points in the process. As Figure 1 shows, nurturing typically occurs after qualification and before closing. Since most of your life science prospects are not ready to buy right now, most of your prospects need nurturing.

Figure 1: A very simplified view of the sales process in the life sciences: We identify leads and we qualify them. If they’re not ready to buy we have to nurture them, and as part of the nurturing process we will occasionally requalify them (by reaching out to them or by watching their responses to our nurturing tactics). Most of the contacts in our CRM will be located somewhere in the loop marked by the red arrows. Put another way, since most of the contacts in our CRM have been qualified and are not yet ready to buy, we should be nurturing most of our contacts.

The different forms of nurturing

Nurturing can take many forms. In fact, every touchpoint we have in our arsenal can be used to nurture clients. We can use the Ladder of Lead Generation to organize our possible nurturing tactics, as shown in Figure 2. All of these tactics, as well as many others, can be used to create and strengthen relationships with prospects, allowing us to help guide their growth and development.

| Rung on the Ladder of Lead Generation | Some of the tactics on this rung that can be used for nurturing |

| Earned Exposure | Books, articles, speaking |

| Content Marketing | White papers, Newsletters, Webinars, Podcasts, Social media |

| Paid Exposure | Websites, Brochures, Ads, Direct mail, Email, Trade shows |

| Personal Interactions | Phone calls, Personal visits, Sales presentations |

Figure 2. The Ladder of Lead Generation organizes the different tactics that can be used to nurture our life science prospects. It’s important to note that the top rungs on the ladder (Earned Exposure and Content Marketing) have the longest reach and are the slowest to yield results. The bottom rungs (Paid Exposure and Personal Interactions) have the shortest reach and are the fastest to yield results.

How buying happens: the four stages of the buying cycle in the life sciences.

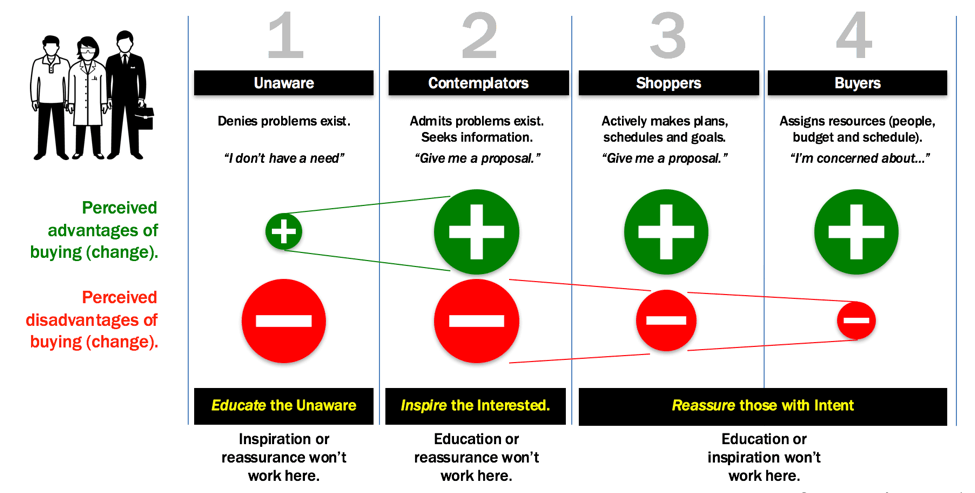

I’ve written about the buying process extensively. If I had to summarize it in a short phrase, it would be this: buying = changing. To understand buying in the life sciences, we need to understand how people change. This is well understood by the scientists who study such things; they’ve identified the four major stages of change that prospects go through in the buying cycle before they actually sign any papers and hand over any money. Here is a quick review of the four stages in the buying (changing) process, which are presented graphically in Figure 3.

Stage 1: Precontemplation. In stage 1, the individual typically denies that there is the need for change. A prospect in this stage will typically be content with the current situation. They might even be in denial about the need for change: “We don’t need a new peptide synthesizer (or diagnostic device, or other life science product/service); the solution we have works just fine.” Or “We don’t need to think about our clinical trials yet; we don’t even have toxicology data or an established formulation.”

Stage 2: Contemplation. In stage 2, contemplators acknowledge that there is an issue and begin to think about the need for change. A contemplator will typically begin to wonder about possible solutions and begin to seek information about them. “The increase in demand is starting to overwhelm our equipment. I wonder if there is a faster machine out there, and what a new one would cost?” Or “Now that we’re starting to get data back from our toxicology studies, we need to begin to think about our phase 1 trial.” There can still be very little overt commitment; contemplators can remain in stage 2 for quite some time.

Stage 3: Preparation. Shoppers—as distinct from buyers—are typically planning to take action in the near future and show increasing signs of commitment. This typically includes a shift from focusing on the past to focusing on the future, and a shift from focusing on the problem to focusing on the solution. “I’ve allocated time to visit the websites of the top three suppliers, and my goal is to talk to these companies before we have our next budget meeting.” The time they spend in this stage can be very brief, as momentum builds towards the next stage.

Stage 4: Action. In stage 4, buyers exhibit the most overt change in behavior. The action stage is the one in which commitments are made—so typically most sales efforts (and most sales training) are focused here. A buyer in stage 4 will have resources assigned to the project and will be actively involved in addressing any problems that arise: “We are ready to buy, but we have a concern about the terms of the contract.”

Figure 3: The Buying Cycle. Buying in the life sciences proceeds in four stages. In the first, prospects perceive the disadvantages of changing as much larger than the advantages, so non-sales-focused education is needed. Inspiration is then needed to increase the perception of the advantages of changing (stage 2). In the last two stages, the perceived disadvantages must be reduced through reassurance.

The support prospects need at each stage of the buying cycle in the life sciences: education, inspiration, reassurance.

Progress through these buying stages is not smooth. The process can move quite rapidly in some stages, and bog down in others. Because life science prospects’ mindsets are changing as they traverse the four stages in the buying cycle, the types of support they need will change as well.

And that’s why employing nurturing correctly is so important.

Prospects in stage 1 need assistance in the form of education. This form could be a course (click here to get an idea on the courses). This is where content marketing can play a key role for life science organizations. White papers, webinars, podcasts—all these can nurture our prospects. Keep in mind the focus on education; to be effective, this must be non-sales-focused, original, valuable thought leadership.

To make the transition from stage 1 to 2, life science buyers need inspiration. Nurturing in this stage will emphasize the large-scale benefits of change: how the prospect’s situation could be significantly improved. This can be achieved through life science case studies or inspirational testimonials. It bears stating explicitly: Supplying education or reassurance when the buyer needs inspiration won’t help the prospect move from one stage to the next.

To make the transition from stage 2 to 3 and from 3 to 4, life science buyers need reassurance. Nurturing in the form of reassurance can take many forms. For example, supplying materials to help a life science buyer make the case to his/her superiors or decision-makers can be very reassuring; “Oh, this seller is helping me all the way through the sales process (so I really trust them).” The reassurance needed by buyers tends to focus frequently on details, such as the terms of the contract, the type of maintenance required, etc. Remember that supplying inspiration or education when the life science buyer needs reassurance won’t work.

Progression through the four stages of change in the life sciences.

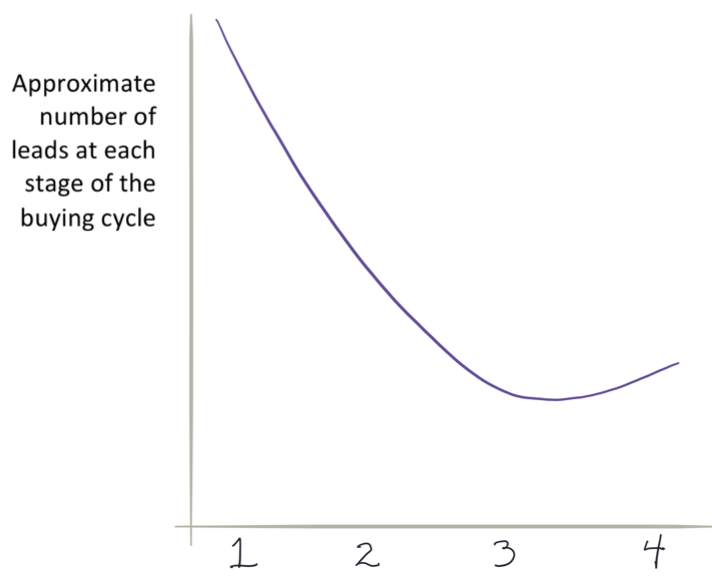

It’s worth pointing out that our life science prospects will not be evenly divided throughout the four stages. Most will be in stages 1 or 2. That is, they don’t see that they have a need to change their situation (stage 1) or they’re considering a purchase “someday” but not thinking seriously about buying (stage 2). They’re not to a point where they’re planning to buy or actively researching their options (stage 3) and they’re certainly not ready to take action, allocate resources and implement changes (stage 4).

Figure 4 shows an approximate breakdown of buyers across the fours stages in the life sciences. These data are approximate; the point here is that most prospects are in stage 1, followed by stage 2. Prospects can remain in these stages for years—sometimes decades. Once they decide to start planning, however, the process can accelerate rapidly. This is why there are so few prospects in stages 3 and 4; they move through them quickly and either close the deal, they decide not to buy from you but buy from someone else, or they decide not to buy and slip back to stages 1 or 2.

Figure 4. This graph shows the approximate number of prospects in each stage of the buying process in the life sciences. Most are in stage 1 (precontemplation), followed by stage 2 (contemplation). Prospects can stay in stage 2 for quite a while—years in some cases. Prospects tend to remain in Stage 3 (planning) a very short time, so the total number of prospects here is small. Prospects in stage 4 (action) will either purchase from you or someone else or slip back to stage 1 or 2.

Why should we nurture our prospects in the life sciences? We nurture them to help them “raise their hands.”

Now that we understand where in the buying process most of your prospects are, it becomes clear why nurturing is so vital. Simply put, if most of them are in stages 1 and 2, we can’t just ignore them and wait for them to raise their hands. Left to themselves, they will almost never raise their hands, at least in a way that’s visible to us. In fact, there is some well-known research by Google that states that buyers go through 57% of the purchase process before ever reaching out to a sales person. The way to change that is by actively and consistently nurturing prospects, wherever they are in the buying cycle.

That’s just one of the many reasons for nurturing. But there are many others, and I’ll cover them, and provide some data about the effectiveness of nurturing, in the next issue.

The Marketing of Science is published by Forma Life Science Marketing approximately ten times per year. To subscribe to this free publication, email us at info@formalifesciencemarketing.com.

David Chapin is author of the book “The Marketing of Science: Making the Complex Compelling,” available now from Rockbench Press and on Amazon. He was named Best Consultant in the inaugural 2013 BDO Triangle Life Science Awards. David serves on the board of NCBio.

David has a Bachelor’s degree in Physics from Swarthmore College and a Master’s degree in Design from NC State University. He is the named inventor on more than forty patents in the US and abroad. His work has been recognized by AIGA, and featured in publications such as the Harvard Business Review, ID magazine, Print magazine, Design News magazine and Medical Marketing and Media. David has authored articles published by Life Science Leader, Impact, and PharmaExec magazines and MedAd News. He has taught at the Kenan-Flagler Business School at UNC-Chapel Hill and at the College of Design at NC State University. He has lectured and presented to numerous groups about various topics in marketing.

Forma Life Science Marketing is a leading marketing firm for life science, companies. Forma works with life science organizations to increase marketing effectiveness and drive revenue, differentiate organizations, focus their messages and align their employee teams. Forma distills and communicates complex messages into compelling communications; we make the complex compelling.

© 2024 Forma Life Science Marketing, Inc. All rights reserved. No part of this document may be reproduced or transmitted without obtaining written permission from Forma Life Science Marketing.